Why Google Will Win the AI Search War (And ChatGPT Will Have to Be Content With Silver)

Google will almost certainly retain its dominance in search despite ChatGPT's explosive growth, according to converging evidence from Datos, Similarweb, Advanced Web Ranking, and major consulting firms.

The core thesis is straightforward: Google processes 373 times more searches than ChatGPT, controls 90%+ of mobile search, and its AI Overviews now reach 1.5 billion monthly users, all while search revenue grew 10% year-over-year.

The data reveals a paradox: AI search tools are expanding the information-seeking market rather than cannibalizing Google. Datos found that 95% of AI platform users continue using traditional search engines, and Semrush's analysis of 260 billion clickstream rows shows ChatGPT adoption does not reduce Google usage.

Meanwhile, Advanced Web Ranking's quarterly CTR studies reveal something even more interesting: Google is successfully absorbing the AI-answer paradigm within its own ecosystem.

Their AI Overview monitoring tool tracked a relentless rise in AI Overviews across SERPs - from 18.55% in Q3 2024 to 49.92% by December, 15 (non-personalized search) - suggesting Google isn't ceding the conversational search experience to ChatGPT but rather integrating it directly into its product.

Heartbeat, Increasing Heartbeat

The Raw Numbers Behind Google's Dominance

The most comprehensive market share data comes from Datos, a clickstream analytics company now owned by Semrush. Their March 2025 research with SparkToro delivered a definitive snapshot: Google commands 93.57% of search market share with approximately 14 billion searches per day. ChatGPT, by comparison, processes roughly 37.5 million search-like prompts daily, representing just 0.25% of the search market. The State of Search Q3 2025 report presented not very different numbers.

What makes these numbers striking is Google's growth trajectory. Despite predictions of decline, Google search volume grew 21.64% from 2023 to 2024. Sessions per user increased from 11.47 to 14.12, a 23% jump.

The "stickiness factor" rose to 25.35%, indicating users return more frequently than ever.

Metric | ChatGPT | Ratio | |

|---|---|---|---|

Daily searches | ~14 billion | ~37.5 million | 373:1 |

Market share | 93.57% | 0.25% | 374:1 |

Sessions per user (2024) | 14.12 | 1.27 | 11:1 |

Stickiness (DAU/MAU) | 25.35% | 16.78% | 1.5:1 |

Zoo Time, She's Dressed to Kill

Advanced Web Ranking's CTR Studies Show the Battlefield in Motion

If Datos provides the aerial view, Advanced Web Ranking's quarterly CTR studies offer the trench-level dispatches. AWR’s research reveals how Google is actively reshaping the search experience through AI Overviews, sometimes at the expense of its own organic listings.

The trend line is unmistakable. AWR's free AI Overview monitoring tool captured AI Overviews appearing in 18.55% of search results in Q3 2024, rising to 29.84% by Q4 2024 (an 11.29 percentage point jump), and reaching 49.92% by Q4 2025 (another 20.08 percentage point increase). That's a 31.37 percentage point surge in AI Overview prevalence within five quarters.

The CTR impact is equally pronounced. In Q4 2024, informational queries on desktop experienced a combined 7.31 percentage point loss in CTR across the first four positions. By Q2 2025, the carnage had spread: commercial queries saw the first four desktop positions lose a combined 10.56 percentage points in CTR. The Science vertical witnessed a staggering 13.86 percentage point combined drop for positions 1-4 on desktop.

Here's where it gets strategically interesting.

AWR's Q3 2025 report revealed a counterintuitive shift: for branded desktop queries, position 1 lost 1.52 percentage points while positions 2-6 gained a combined 8.71 percentage points. Clicks are spreading rather than disappearing; users are scanning further down the page before committing.

Quarter | AI Overview % | Position 1 CTR | Notable Pattern |

|---|---|---|---|

Q4 2024 | 29.84% (+11.29 pp) | +1.15 pp | Informational -7.31 pp |

Q2 2025 | 54.70% (+24.86 pp) | -2.16 pp | Commercial -10.56 pp |

Q3 2025 | 43.61% (-11.09% pp) | -0.99 pp | Pos 2-6 +8.71 pp |

The Health vertical tells perhaps the most compelling story. AWR found it has the one of the highest frequency of AI Overviews of any industry, and unsurprisingly, the first three positions on desktop registered a combined 6.55 percentage point loss in Q2 2025. Google is using its own AI feature to cannibalize its own organic results. That's not a defensive company; that's a company confident enough to shuffle value between products.

The Thunder of Stampeding Rhinos, Elephants, and Tacky Tigers

What Similarweb Traffic Data Reveals

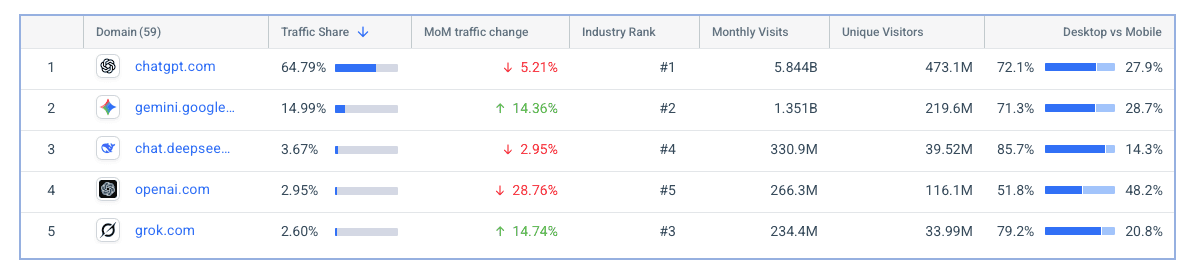

Similarweb's traffic intelligence paints ChatGPT as a genuine phenomenon, but not yet a Google killer. As of August 2025, ChatGPT received 5.8 billion monthly visits from 489 million unique visitors, making it the 5th most visited website globally. Year-over-year growth hit 115.9% in late 2024.

Moreover, as far as today December 18, we see its usage is diminishing (while Google Gemini is growing):

Yet perspective matters. Google Search receives 83.9 billion global visits monthly: more than 14 times ChatGPT's traffic.

More critically, 95% of ChatGPT users still also use Google. Similarweb found only 23 million users worldwide are exclusive to ChatGPT, suggesting AI search functions as a complement rather than substitute.

Perhaps most significant: Similarweb's July 2025 zero-click study found searches ending without a click rose from 56% to 69% following Google's AI Overviews launch.

This aligns with AWR's CTR findings: Google is capturing the AI-answer paradigm within its own ecosystem rather than ceding it to competitors.

Census, the Latest Census

Consulting Firms Project Google's Staying Power

Gartner's headline prediction - that traditional search volume would drop 25% by 2026 due to AI chatbots - has become a benchmark for measuring disruption. Yet their own spending forecasts show the AI market reaching $632 billion by 2028, with established players like Google positioned to capture the lion's share through integration rather than displacement. Moreover that same prediction has been deemed flawed for many reasons by “better informed” sources like Roger Montti, Danny Goodwin or Bon Knorpp.

McKinsey's October 2025 research projects AI-powered search will influence $750 billion in consumer spending by 2028, but brands could lose up to 50% of traffic if they fail to adapt. Notably, this risk applies to publishers and advertisers, not necessarily to Google itself.

Seer Interactive's September 2025 study offers the most granular CTR analysis.

Tracking 3,119 search terms across 42 client organizations with 25.1 million organic impressions, they found organic CTR for queries with AI Overviews plummeted from 1.41% to 0.61%: a 57% decline.

But here's the kicker: queries without AI Overviews also declined dramatically, losing 41% of their CTR year-over-year.

Users are seeking answers elsewhere before Google, but Google's AI integration is partially mitigating that shift.

And It Ain't Me Who's Gonna Leave

Google's Distribution Fortress

Google's competitive moat extends far beyond product quality into structural advantages that no competitor can replicate quickly. The distribution fortress operates across three interlocking layers: default positioning, platform ownership, and mobile dominance.

Default search agreements form the foundation. Google pays Apple approximately $20 billion annually (36% of Safari search ad revenue) to remain the default on iOS devices; a deal in place since 2002 that Microsoft couldn't break even by offering Apple 90% of Bing's ad revenue.

Chrome's browser dominance extends this advantage. Chrome commands 71.22% of global browser market share as far as November 2025 with 3.45-3.62 billion users worldwide. Every Chrome installation defaults to Google Search.

Android's mobile platform completes the ecosystem. With 71.94% global mobile market share (reaching 85%+ in emerging markets), Android devices default to Google Search.

Google's mobile search market share sits at 93-95%, a near-monopoly that ChatGPT's app-based model cannot challenge at scale.

The Bullets Cannot Cut You Down

AI Overviews, CTR Dynamics, and Monetization Advantages

Google's response to AI search - AI Overviews, AI Mode, Web Guide - demonstrates the power of integrated adaptation.

AI Overviews, launched in May 2024 and now reaching 1.5 billion monthly users across 100+ countries, appears in 11-47% of Google queries depending on query type. Queries with 8+ words are 7x more likely to trigger AI Overviews.

The financial implications are remarkable. Despite integrating AI that theoretically cannibalizes ad clicks, Google's search advertising revenue reached $50.7 billion in Q1 2025, up 10% year-over-year. Full-year 2024 revenue hit $264.5-273.4 billion, growing 14.9%.

Compare this to OpenAI's position: $10 billion ARR by June 2025, but $5 billion in losses during 2024. ChatGPT Pro at $200/month reportedly fails to break even due to computational costs.

Google can subsidize AI search through advertising; ChatGPT cannot match this without raising prices or finding equivalent monetization (and it is still trying to figure out how to add advertising into the chatbox).

Flying, Domestic Flying

Industry-by-Industry Impact from AWR's Research

AWR's quarterly reports reveal that AI Overviews don't affect all verticals equally. Some industries experience devastating CTR erosion while others remain relatively insulated.

Most Vulnerable Industries:

Health: Highest AI Overview frequency. Q2 2025 saw positions 1-3 lose a combined 6.55 pp

Science: Q4 2024's biggest loser with position 1 dropping 6.03 pp. Q2 2025: combined 13.86 pp decline

Personal Finance: Combined 5.85 pp decline for top two positions (Q2 2025)

Education: Combined 5.94 pp decrease for positions 1-3 (Q2 2025)

More Resilient Industries:

News: Position 1 largely unaffected: breaking news requires recency AI summaries can't provide

Travel: Showed gains in Q3 2025, with position 2 rising 2.46 pp

Law, Government & Politics: Highest single-position CTR increase in Q4 2024 (+7.39 pp)

Industry | Q2 2025 CTR Δ | AIO Prevalence | Pattern |

|---|---|---|---|

Health | -3.38 pp | Highest | Severe decline |

Science | -3.38 pp / -6.03 pp | High | Severe decline |

Family & Parenting | -6.81 pp | High | Highest decline |

News | Stable | Low | Resilient |

Travel | +2.46 pp (Pos 2) | Moderate | Gaining |

Not Enough to Go Round

ChatGPT as Formidable but Constrained Challenger

ChatGPT's position as the strongest second-place competitor is unambiguous.

The platform reaches 800 million+ weekly active users (up from 300 million in December 2024), processes over 2 billion daily queries, and commands 62.5% of the B2C AI subscription market. Enterprise adoption is extraordinary: 92% of Fortune 500 companies use OpenAI products.

However, structural limitations constrain ChatGPT's ceiling.

93.7% of ChatGPT searches are informational versus only 0.1% transactional: users research on ChatGPT but buy through Google or other surfaces. The platform excels at complex, conversational queries but lacks infrastructure for local search and it is still in its infancy for e-commerce integration, and commercial queries that drive Google's advertising revenue.

Most concerning for OpenAI: growth is slowing. Sensor Tower data from December 2025 shows only 6% global MAU growth from August to November 2025, compared to 180% year-over-year gains earlier. ChatGPT's share of global AI MAU dropped 3 percentage points in late 2025.

Do Not Show Any Fear

The Coexistence Equilibrium

The most important finding across all data sources is that Google and ChatGPT are not engaged in zero-sum competition.

Semrush's August 2025 analysis of 260 billion rows of clickstream data found ChatGPT adoption does not reduce Google usage: users expanded their total information-seeking rather than substituting platforms.

Datos found 99% of AI platform users continue using traditional search engines.

This coexistence equilibrium makes sense given usage patterns:

ChatGPT dominates for creative/ideation tasks (32%), practical guidance (24%), and technical problem-solving (22%), use cases Google historically underserved.

Google dominates for transactional queries, local search, navigation, and commercial intent, categories ChatGPT barely competes in.

AWR's Q3 2025 finding that 4+ word queries were the only category maintaining steady CTR offers a clue about the future equilibrium.

Specific, intent-rich queries - the kind that convert - continue rewarding top positions. Generic informational queries are fragmenting across AI answers, but that's a trade Google seems willing to accept.

Conclusion: The Town Turned Out to Be Bigger Than Anyone Thought

The evidence points to a clear conclusion: Google will maintain search dominance not by defeating ChatGPT but by successfully integrating AI while preserving distribution and monetization advantages.

The market is expanding rather than being divided; Google grew 21.64% in 2024 despite ChatGPT's explosive rise.

Advanced Web Ranking's longitudinal CTR studies reveal Google's willingness to cannibalize its own organic listings through AI Overviews, which is a confident bet that controlling the AI-answer experience within Google is preferable to ceding it to external platforms.

The 36.15 percentage point surge in AI Overview prevalence from Q3 2024 to Q2 2025, combined with substantial CTR redistribution rather than elimination, suggests Google is reshaping rather than defending.

ChatGPT’s position as the strongest challenger in Google’s history is secure.

Its 800 million weekly users, enterprise penetration, and superior conversational capabilities have permanently changed how people seek information. But the 373:1 search volume gap, combined with Google's distribution fortress, browser dominance, mobile platform control, and proven monetization, creates structural advantages that cannot be overcome through product quality alone.

Or, to paraphrase the Sparks: this town was big enough for the both of them. The showdown everyone predicted turned out to be a partnership nobody wanted.

Article by

Gianluca Fiorelli

With almost 20 years of experience in web marketing, Gianluca Fiorelli is a Strategic and International SEO Consultant who helps businesses improve their visibility and performance on organic search. Gianluca collaborated with clients from various industries and regions, such as Glassdoor, Idealista, Rastreator.com, Outsystems, Chess.com, SIXT Ride, Vegetables by Bayer, Visit California, Gamepix, James Edition and many others.

A very active member of the SEO community, Gianluca daily shares his insights and best practices on SEO, content, Search marketing strategy and the evolution of Search on social media channels such as X, Bluesky and LinkedIn and through the blog on his website: IloveSEO.net.

stay in the loop